pan-Canadian Pharmaceutical Alliance (pCPA): December 2018 Negotiation Status Update

The pan-Canadian Pharmaceutical Alliance Office (pCPAO) issued the status of brand negotiations as of December 31, 2018. The key highlights since the November update are:

- 5 products received a final HTA recommendation, for a total of 13 files under consideration

- 2 products initiated pCPA negotiations, for a total of 46 active negotiations

- 7 negotiations were completed for a total of 232 completed negotiations

- No negotiations were closed since the last update, for a total of 30 closed negotiations

- The pCPA decided not to negotiate collectively on 2 files, for a total of 60 declined negotiations

pCPA Process Timelines Highlights

Since the release of the pCPA Process Guidelines in May 2018, there has been an observable, downward trend in the average number of months files have been under pCPA Consideration and under Active Negotiations. Undoubtedly, one of the factors has been the reduction in the number of files spending extended periods of time within these two process phases outlined in the graph below.

Files Under pCPA Consideration

The products “under pCPA Consideration” have been reviewed by CADTH but have not yet been initiated for negotiation or closed without negotiations.

Five new drug products received a CDEC or pERC recommendation or notification to implement in December 2018, for a total of approximately 13 products under pCPA Consideration.

| Brand Name | Generic Name | Manufacturer | Indication | HTA Recommendation |

|---|---|---|---|---|

| Aermony RespiClick | fluticasone propionate | TEVA Canada Innovation | Asthma | Reimburse with clinical criteria and/or conditions |

| Arbesda RespiClick | fluticasone propionate / salmeterol xinafoate | TEVA Canada Innovation | Asthma

Follicular Lymphoma (previously untreated) |

Reimburse with clinical criteria and/or conditions |

| Perjeta-Herceptin Combo Pack | Pertuzumab-Trastuzumab Combo Pack | Hoffmann-La Roche | Early Breast Cancer | Do not reimburse* |

| Opdivo | Nivolumab | Bristol-Myers Squibb Canada | Hepatocellular Carcinoma (HCC) | Does not recommend |

| Soliqua | lixisenatide + insulin glargine | Sanofi-Aventis Canada Inc. | Diabetes mellitus, Type 2 | Reimburse with clinical criteria and/or conditions |

*Added to the “No Negotiations” list in the same month so NOT included in the count of Files Under pCPA Consideration

Negotiation Initiation

The pCPA initiated 2 new negotiations since the last update, for a total of 46 active negotiations.

| Brand Name | Generic Name | Manufacturer | Indication | HTA Date | Time to Initiation* |

|---|---|---|---|---|---|

| Duodopa | Levodopa / carbidopa | AbbVie** | Parkinson’s Disease | 22 Aug 18 | 115 days |

| Yervoy/Opdivo | Nivolumab/ipilimumab | Bristol-Myers Squibb | Renal Cell Carcinoma | 16 Nov 18 | 29 days |

*Approximation: Negotiation initiation date assumed to be mid-month for the purposes of the calculation

** Drug Plan Submission

Signals Decoded:

Renal Cell Carcinoma becomes the second indication for Yervoy/Opdivo to be initiated for negotiation by the pCPA, presumably to be considered along side the currently active negotiation for metastatic melanoma (initiated in June 2018). Negotiations for Duodopa have been initiated following a drug plan submission, and subsequent recommendation from CADTH. Interestingly, the last pCPA negotiation initiated following a drug plan submission was Xolair (severe asthma) which remains under active negotiations more than 30 months after the CDR recommendation was issued.

Process Timeline Update: The chart above shows that the average time files have remained under pCPA consideration has decreased from its July 2018 peak. In addition, the number of files under consideration each month has been significantly reduced from a high of 30 in May-June to 11 in November and now 13 in December.

Negotiations Completed/Closed

7 negotiations were completed, and no negotiations were closed since the last update, for totals of 232 completed and 30 closed negotiations.

| Brand Name | Generic Name | Manufacturer | Indication | Negotiation Initiation | Duration of Negotiation * |

|---|---|---|---|---|---|

| Siliq | brodalumab | Valeant | Moderate to severe plaque psoriasis | October 2018 | 61 days |

| Alecensaro | alectinib | Hoffmann-La Roche | Non-small cell lung cancer (NSCLC) | September 2018 | 91 days |

| Alecensaro | alectinib | Hoffmann-La Roche | Locally advanced or metastatic non-small cell lung cancer (second line) | September 2018 | 91 days |

| Actemra | tocilizumab | Hoffmann-La Roche | Giant cell arteritis | July 2018 | 153 days |

| Maviret | glecaprevir pibrentasvir | AbbVie | Hepatitis C, chronic | June 2018 | 183 days |

| Izba | travoprost ophthamic | Novartis | open angle glaucoma | April 2018 | 244 days |

| Rexulti | Brexpiprazole | Otsuka-Lundbeck | Schizophrenia | April 2018 | 244 days |

*Approximation: Negotiation initiation and completion date assumed to be mid-month for the purposes of the calculation

Signals Decoded:

December saw the completion of a range of files that have been under active negotiations for between 2 and 8 months, including products in busy and presumably, competitive therapeutic spaces (Siliq, Maviret), products with multiple indications (Alecensaro) and expanded indications for previously negotiated products (Actemra).

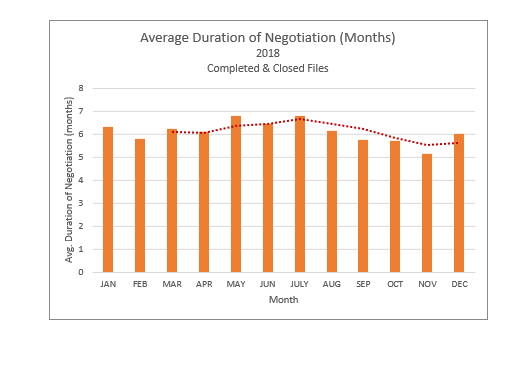

Process Timeline Update: The chart above shows that the average time files have remained under active negotiation has remained fairly stable, fluctuating between 5 and 7 months throughout 2018. In addition, the number of files under active negotiations has decreased in recent months from an all-time high of 57 in October to 46 in December.

No Negotiations

The pCPA decided not to negotiate 2 files since the last update, for a total of 60 drug products for which the pCPA has decided not to negotiate collectively.

| Brand Name | Generic Name | Manufacturer | Indication | Recommendation | HTA Date | Time to Decision* |

|---|---|---|---|---|---|---|

| Gazyva | Obinutuzumab | Hoffmann-La Roche | Follicular lymphoma |

Does not recommend

|

November 16, 2018 | 29 days |

| Perjeta-Herceptin Combo Pack | Pertuzumab-Trastuzumab Combo Pack | Hoffmann-La Roche | Early Breast Cancer |

Do not reimburse

|

December 14, 2018 | 1 day |

To receive updates similar to this one please be sure to sign up for MORSE Signals, our free e-mail newsletter service.